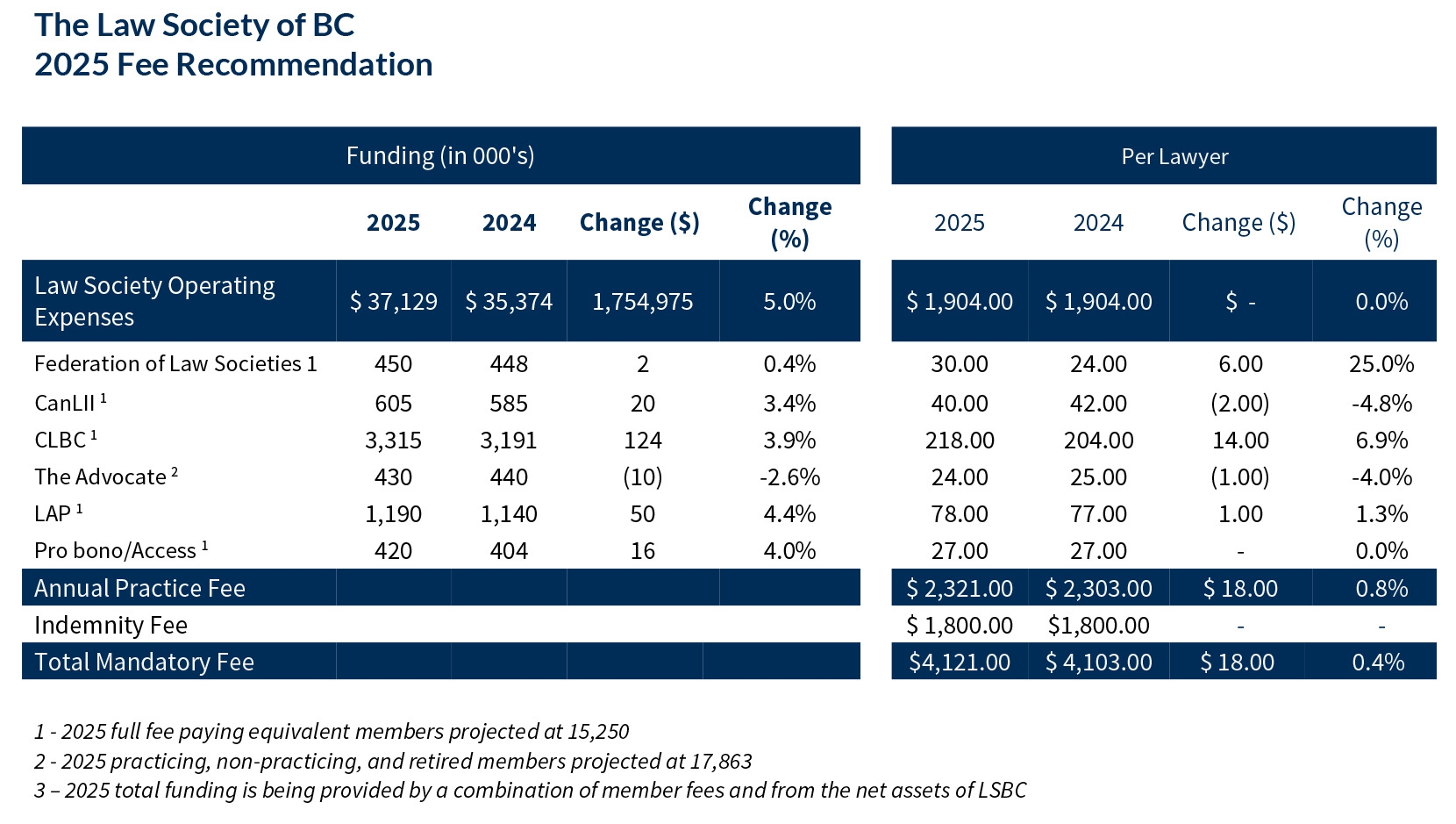

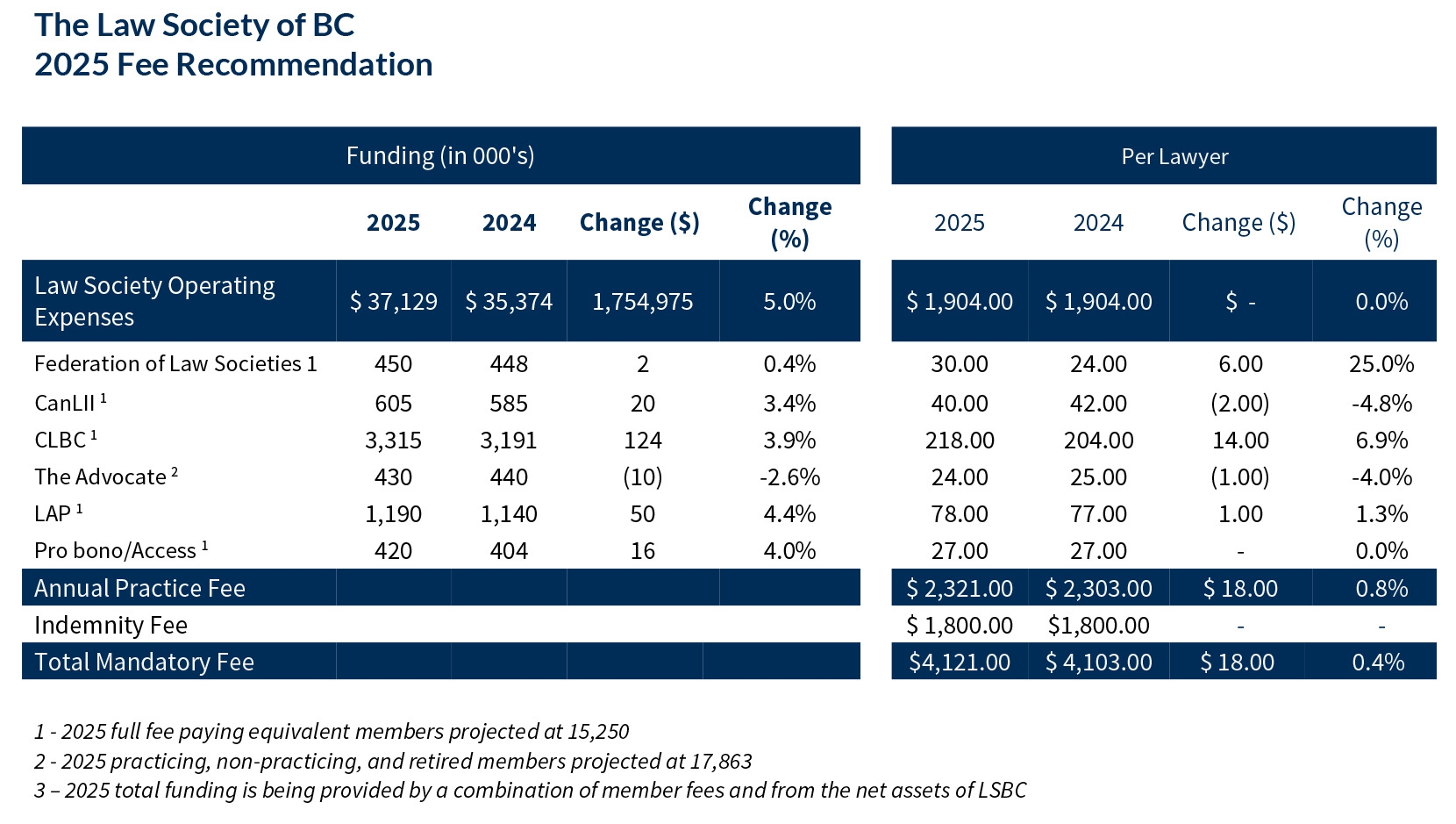

The Benchers have approved the 2025 practice fee and indemnity fee, as recommended by the Finance and Audit Committee. The total annual fee for full-time practising, indemnified lawyers for 2025 will be $4,121, an increase of $18 from 2024 due to an increase to the external organizations funded by the practice fee. The portion of the practice fee supporting the Law Society operations, strategic plan, along with key operational priorities, stays the same. The full-time indemnity fee also remains the same at $1,800.

Practice fee

The Benchers have set the 2025 fees pursuant to the Legal Profession Act based on a thorough review of the Law Society’s finances by the Finance and Audit Committee. The Finance and Audit Committee met with senior management to review the proposed 2025 fees and budgets for the General Fund and the Lawyers Indemnity Fund. The Finance and Audit Committee also reviewed the fee proposals from a number of organizations and programs supported by Law Society fees, including Courthouse Libraries BC, the Lawyers Assistance Program, The Advocate, the Federation of Law Societies of Canada, the Canadian Legal Information Institute, and the delivery of pro bono and access to legal services. Based on these meetings and reviews, the Finance and Audit Committee made recommendations to the Benchers regarding the amounts from the practice fee that should be allocated to each of these organizations and programs. These recommendations were approved by the Benchers at the September 20, 2024 Bencher meeting.

The overall objective when setting the fees is to ensure that operations are appropriately funded to enable the Law Society to efficiently and effectively fulfill its statutory mandate of protecting the public interest in the administration of justice.

Law Society Operations

The focus of the 2025 General Fund budget, in addition to delivering the strategic plan and core regulatory programs, and meeting key performance measures, is supporting regulation to ensure that the Law Society remains an innovative and effective professional regulatory body.

There are several key initiatives in 2025, including: 1) work relating to the transition to a Single Legal Regulator 2) continued work on the review of alternative pathways to lawyer development and licensing 3) Innovation Sandbox initiatives to improve access to legal services 4) the review of regulatory processes to implement continuous improvement initiatives 5) implementation of recommendations to review regulatory processes with respect to the Indigenous investigations and hearings 6) continued focus on anti-money laundering initiatives 7) enhanced practice support and online courses 8) continued implementation of the diversity action plan, and 9) developing a comprehensive roadmap for advancing the information technology infrastructure.

2025 Operating Revenues

General Fund operating revenues in 2025 are projected to be $35.6 million, $0.6 million (1.6%) over the 2024 budget, due primarily to an increase in the number of lawyers year over year. The budgeted revenue is based on estimates of 15,250 full-time equivalent practicing lawyers and 646 PLTC students. Interest income is still expected to be higher than historical years but will be lower than 2023 actuals and 2024 forecast, as interest rates have started to trend down. Other revenues are expected to be at similar levels to historical actual figures.

2025 Operating Expenses

General Fund operational expenses are expected to be $37.1 million, a 5% increase over 2024. Expense increases are primarily related to general salary increases, including market benchmarking for 2025, general inflationary increases to costs, and the addition of a select staff positions. Other areas that have specific increases include costs relating to public adjudicator lawyer per diems and information technology costs.

General Fund Net Assets

The General Fund remains financially sound, with $37 million in net assets at the end of 2023 (excluding the TAF net assets). The net assets consist of capital assets, primarily the 845 Cambie Street building, the capital plan, and a working capital reserve.

Trust Administration Fee

The goal of the Trust Assurance program is to ensure that law firms comply with the rules regarding proper handling of clients’ trust funds and trust accounting records. This is achieved by conducting trust accounting compliance audits at law firms, reviewing annual trust reports, and providing member advice and resources. The compliance audit program ensures that all firms are audited at least once within a six-year cycle, and includes audits of higher-risk practice areas at least every four years.

The trust administration fee (TAF) is currently set at $15 per transaction and has been at this level for the past 10 years. In order to fund the Trust Assurance program, and to provide excess revenues to the Part B indemnity program to help cover theft claims, the TAF will be increased to $20 per transaction. The number of real estate unit sales has continued to decrease from past years, bringing in less revenue. It should also be noted that when the Part B indemnity program was implemented, the Lawyers Indemnity Fund fee did not increase.

The Federation of Law Societies of Canada

The allocation in the practice fee will increase to $30 per lawyer to fully fund The Law Society of BC’s portion of Federation funding. The Federation provides a national voice for provincial and territorial law societies on important national and international issues.

The Canadian Legal Information Institute

The Canadian Legal Information Institute (CanLII) fee will decrease to $40 per lawyer. CanLII is a not-for-profit organization initiated by the Federation of Law Societies of Canada, with the goal to make primary sources of Canadian Law accessible for free on its website at www.canlii.org. All provincial and territorial law societies have committed to providing funding to CanLII.

Courthouse Libraries BC

Courthouse Libraries BC (CLBC) provides lawyers and the public in BC with access to legal information, as well as training and support in accessing and using legal information. Through its information services, curation of print and digital collections, website content and training, the library provides practice support for lawyers and access to justice support to the public across the province through its 31 physical locations. CLBC has requested $3,315,000 to support increasing costs and information technology needs. The allocation of the practice fee will increase to $218 per lawyer to fully fund the request from the CLBC for their operating budget.

The Advocate

The Advocate per lawyer funding will decrease to $24 per lawyer to fund $430,000 for their 2025-2026 operating budget. The Advocate publication is distributed bi-monthly to all BC lawyers, including practising, non-practising and retired lawyers.

Lawyers Assistance Program

The Lawyers Assistance Program (LAP) provides confidential outreach, education, support and referrals to lawyers and other members of BC’s legal community. LAP funding has been set at $1,190,000, funded through a practice fee allocation of $78 per lawyer.

Pro Bono Funding

The Law Society of BC contributes funding to support pro bono and access to legal services. The funding is set at $420,000 and is sent to the Law Foundation for distribution. This is funded through a practice fee allocation of $27 per lawyer.

Lawyers Indemnity Fund Fee

Despite rising claims costs, the indemnity fee will remain at $1,800 (full-time) and $900 (part-time) for 2025. The number of claim reports has increased to the highest level in the 38-year history of the indemnity program, fueling a corresponding upward trend in claim reserves. However, prudent management of claims and positive investment results have allowed the fee to remain stable.

Recently, the frequency of Wills and Estates and Family law claims have increased markedly. Changes in Real Estate practice, including the foreign buyers tax, property transfer tax issues, and the new Land Owner Transparency Act requirements have resulted in increased claims. Estate planning claims arising from the BC Property Taxation Branch applying the anti-avoidance rule to certain transactions have also added cost pressures. These transactions often involve two-step transfers where legal title is transferred to a related person and then back to the original transferor in trust. To assist the profession in avoiding claims, LIF will continue to focus on emerging and elevated risk topics in its loss prevention initiatives.

Total fee comparison with other law societies*

For more information

If you have questions about the financial information in this notice, please contact Jeanette McPhee, Chief Financial Officer and Senior Director of Trust Regulation, by email to jmcphee@lsbc.org.